triple bottom stocks meaning

How A Triple Top Stock Pattern Develops Ive also learned that the Triple Top Stock Pattern is basically a reversal pattern. Tools within the triple bottom line help to measure benchmark set goals improve and eventually evolve toward more sustainable systems and models.

Bearish Bullish Reversals Bdo Unibank Inc

The opposite of a Triple Top is a Triple Bottom obviously and we will talk about that in another article.

. There are two types of breakout trading strategies. Because of its long-term nature weekly charts can be best suited for analysis. While this pattern can form over just a few months it is usually a long-term pattern that covers many months.

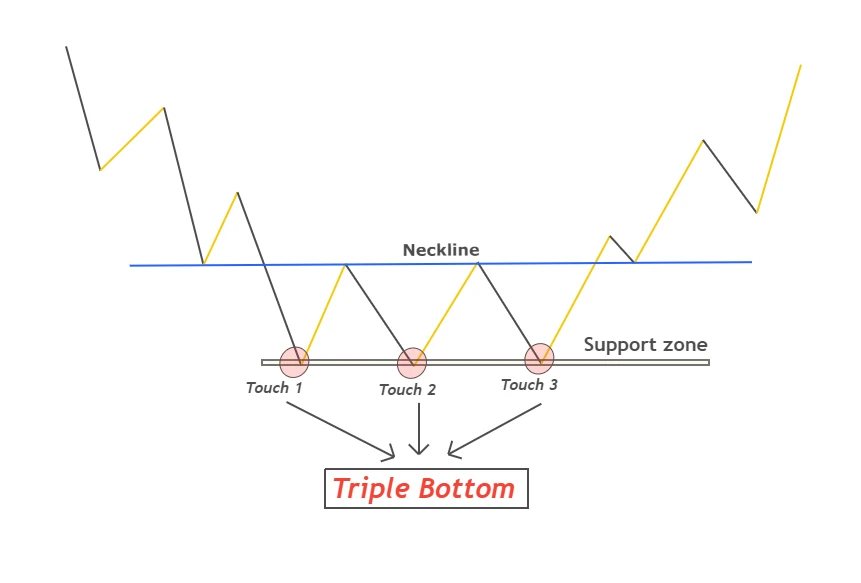

The triple bottom formation is formed because investors and hedge funds think that theres a possible trend reversal. This pattern is rare but a very reliable buy signal. DoubleTriple Bottoms and Tops.

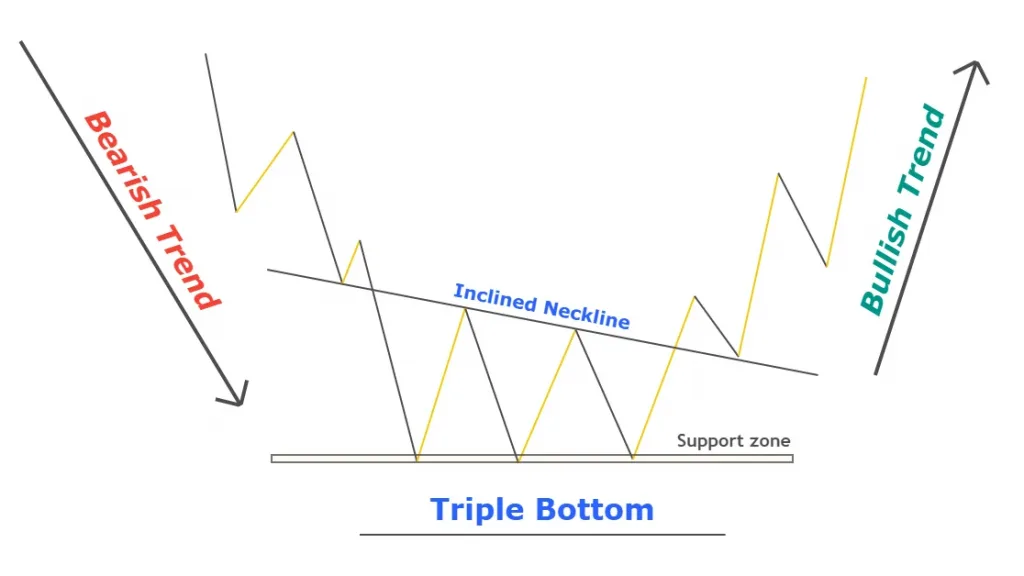

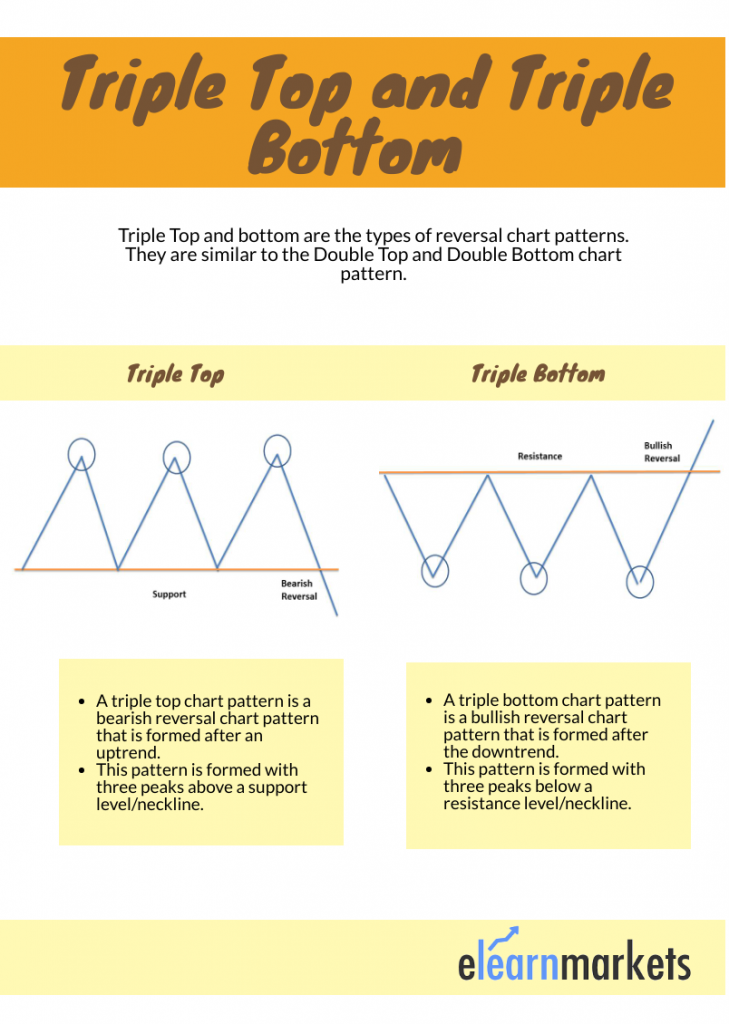

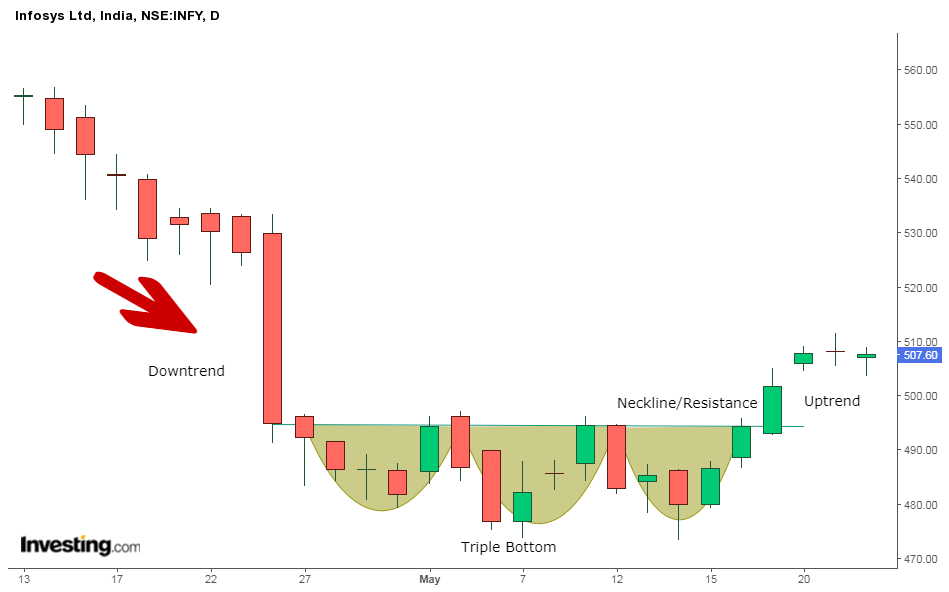

A triple bottom chart which has three lows signals a reverse of the current downtrend. The triple bottom is the opposite of a triple top. Triple Bottom Chart Pattern Triple Bottom is a chart pattern with three bottoms very close in price.

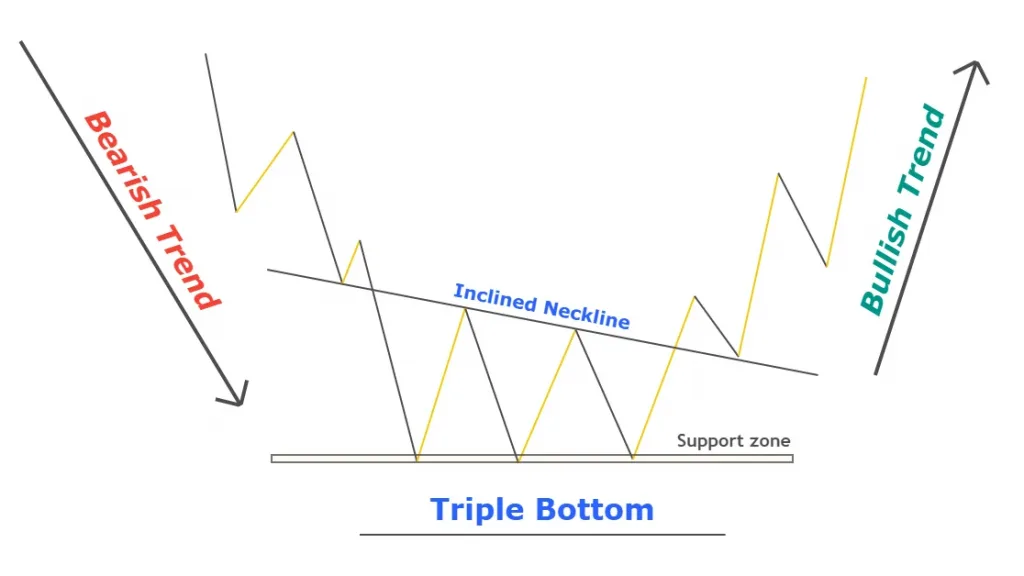

Triple top and triple bottom are reversal chart patterns used in the technical analysis of stocks commodities currencies and other assets. The chart above shows Dupont DD with a reversal Triple Bottom Breakdown in the first half of 2008 and then a continuation Triple Bottom Breakdown in the second half. This is a bullish reverse pattern that forms after a significant downward price trend.

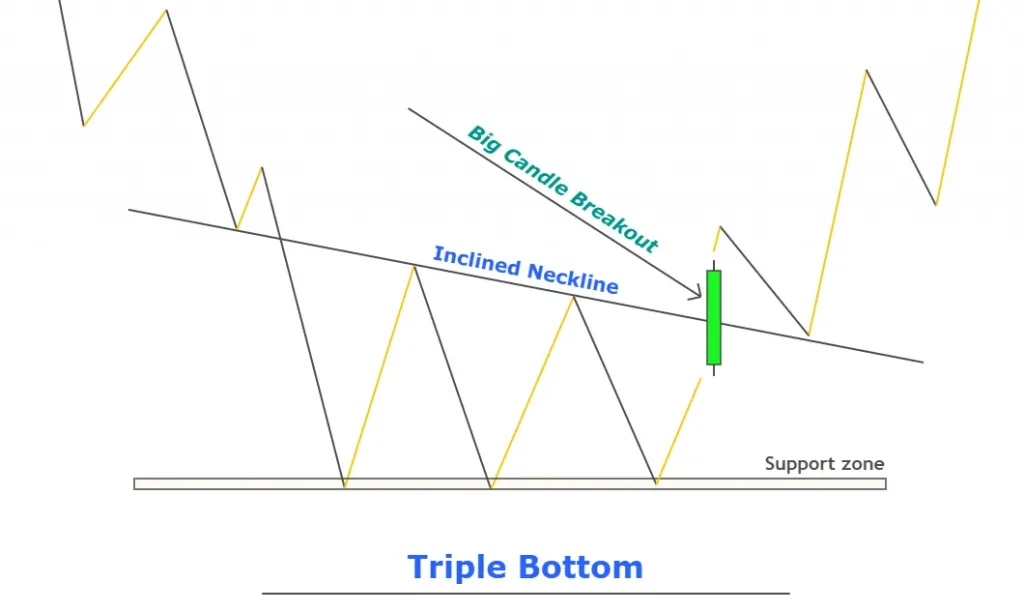

A triple bottom stock pattern is possible on a line chart a bar chart or a candlestick. But for the pattern to be termed as a triple top it has to be found after an uptrend. The triple bottom is a bullish reversal chart pattern that could be an indication that sellers bears are losing control of a downtrend and that buyers bulls are taking over.

As major reversal patterns these patterns usually form over a 3- to 6-month period. The triple bottom line definition brings people and the. The triple bottom pattern is identical to the that of the triple top except that it occurs at the bottom that is it looks like an inverted triple top.

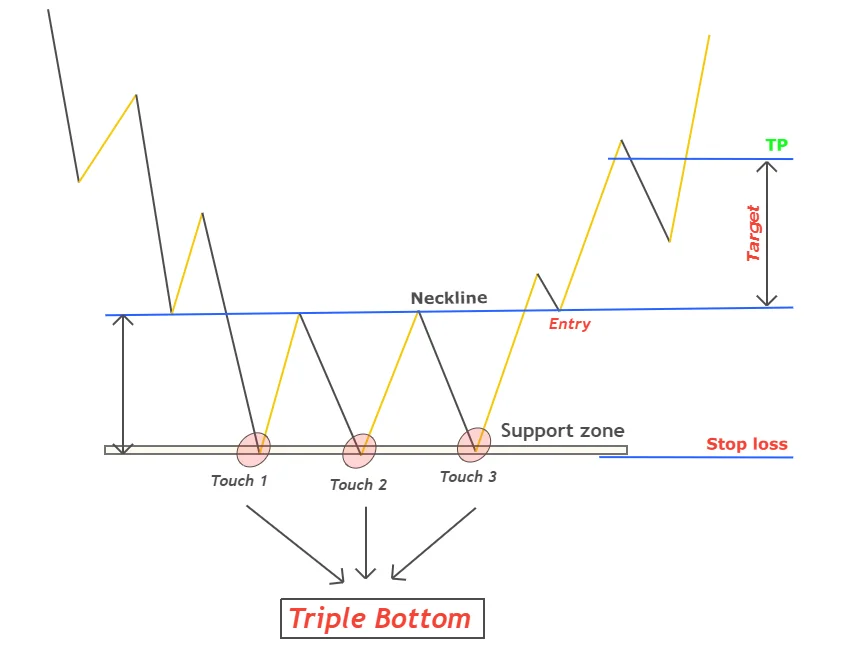

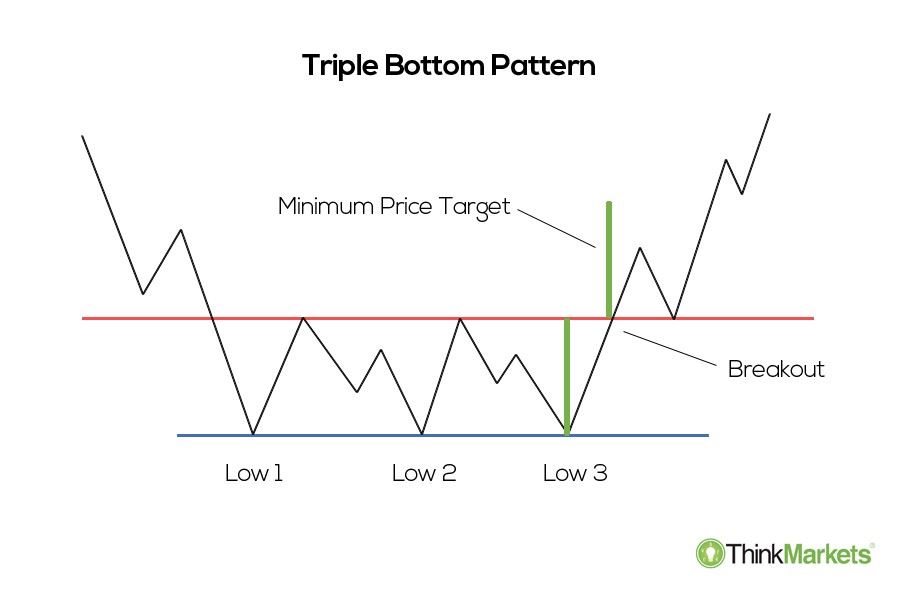

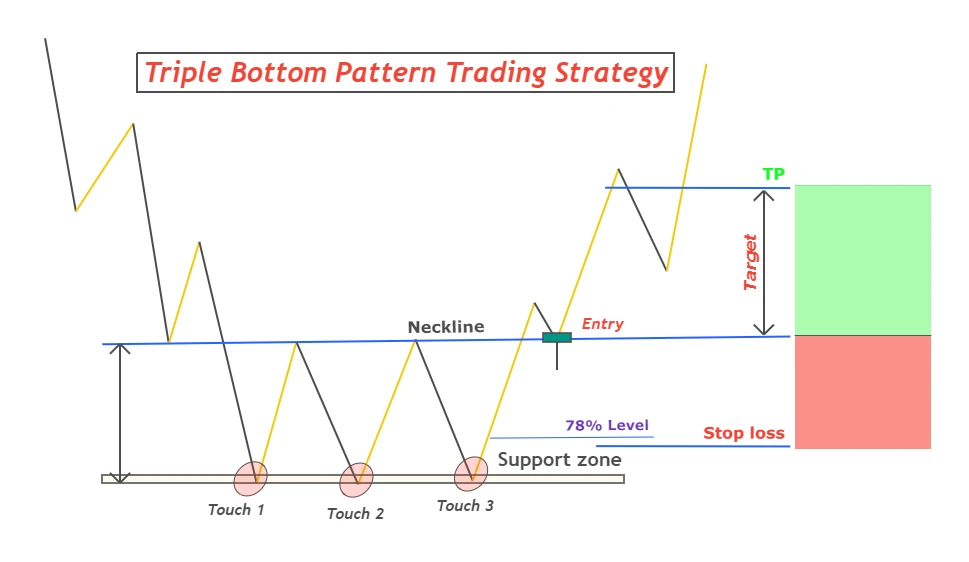

Shorting breakouts triple tops. The Triple Bottom stock pattern is a reversal pattern made up of three equal lows followed by a breakout above resistance. Events that impact markets stocks IPOs commodities forex from regional to international Weve got it all covered.

The bounce peaks and falls again to re-test the first low range before bouncing again and breaking the peak of the prior bounce as the stock moves higher. This chart pattern can be present on all time frames. While it is sometimes difficult to distinguish between reversal.

After the first low price corrected higher and formed a swing high followed. It shows that the price of an asset is no more falling and could get higher. This means implications there have been three failed attempts at making new lows in the same area followed by a price move up through resistance.

They are extensions of the Double Top and Double Bottom chart patterns. Whereas Triple Bottom is a bullish chart reversal pattern that leads to the trend change to the upside. Triple bottom patterns are a bullish pattern.

AUS AUS USA UK NZ CA. The chart example above shows a triple bottom formation that turned the EURGBP forex pair to the upside after a downtrend. The triple bottom line is a transformation framework for businesses and other organizations to help them move toward a regenerative and more sustainable future.

Here are some quick triple bottom line facts. It is an economic concept that includes three aspects in its functioning. Triple Bottom - Triple Bottom Pattern A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed by a price move up through resistance.

Social environmental and financial. After the stock breaks out the first price target is the width of the triple bottom or triple top. Made up of three peaks a triple top indicates that the asset may no longer be coming up.

It consists of three valleys or support levels. After that price moves up then pulls back down to the first and second support. Buying breakouts triple bottoms.

Lower prices may be on the way. After that price moves back down to the first valley level and it holds that first support level thus creating a double bottom. The triple bottom pattern is a bullish reversal pattern.

Triple Top is a bearish reversal chart pattern that leads to the trend change to the downside. There are three distinct bottoms B1 B2 and B3 and the triple bottom confirmation occurs when the price goes above the tops T1 and T1 that are formed between these bottoms. Triple Bottom Line Definition and Example Triple Bottom Line Meaning Stock Market Terms Related Terms Means.

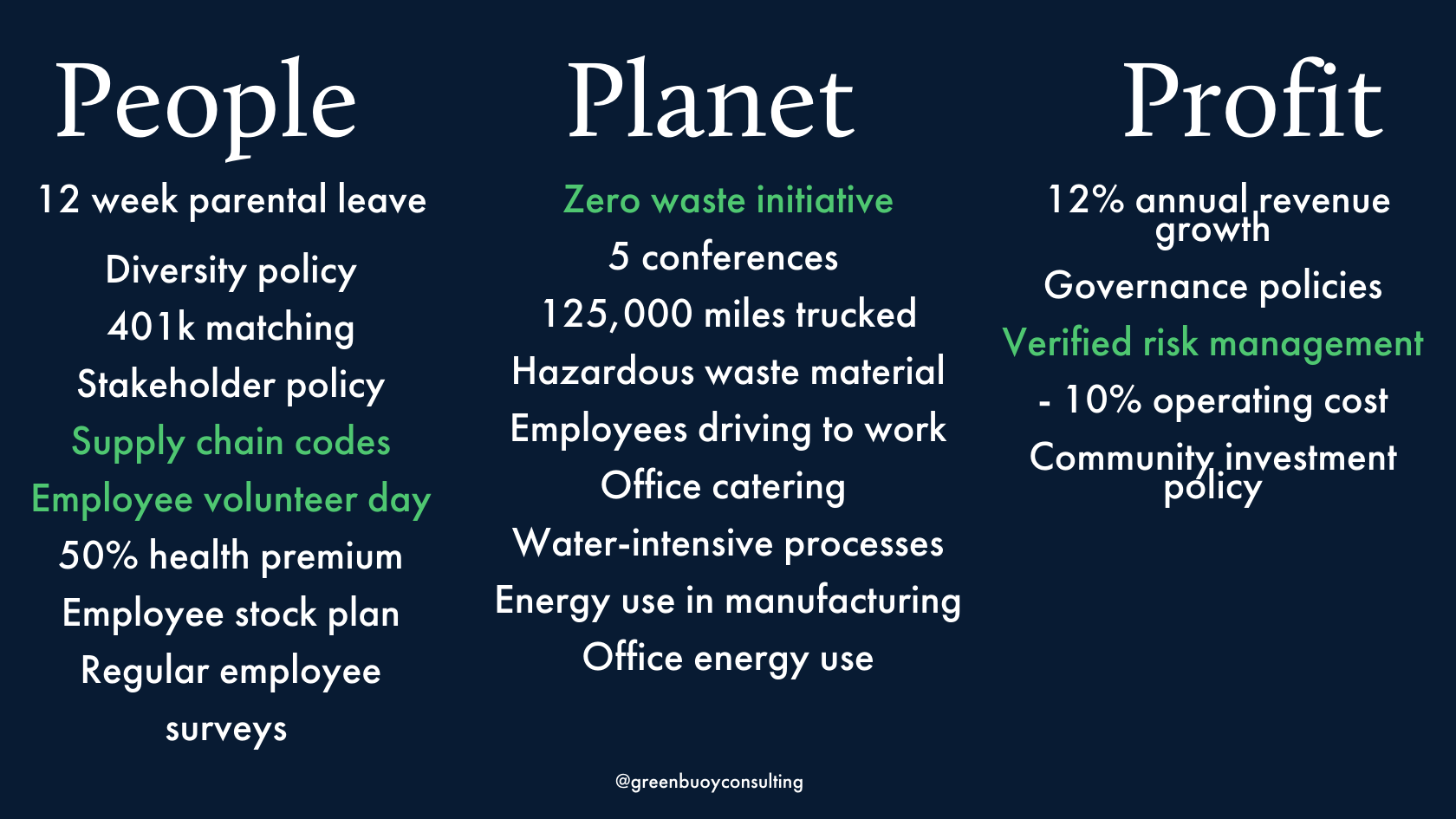

Triple Top and Triple Bottom patterns are the types of reversal chart patterns. The difference between triple tops and triple bottoms is the direction of the market. The triple bottom line TBL is a business and accounting framework that believes companies should care about social and environmental concerns just as they do their profits.

These three bottom lines include the people planet and profits or the 3Ps. This approach suggests that there should not be one but three bottom lines that a company adheres to. More Rectangle Definition and Trading Tactics.

The bottom line has always been a reference to financial statements ending with a companys profit or losses. Double bottoms are trend reversal formations. The Triple Bottom Reversal is a bullish reversal pattern typically found on bar charts line charts and candlestick charts.

After the first valley is formed price goes up either quickly or gradually. Its created when price bounces off support 3 time at similar levels. Its a sign the buyers are coming in the market to.

A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. Most of the rules associated with the triple. Covid-19 Stock Market Commodities World.

The pattern is shaped like a W where a new low is established then a bounce higher. A Triple Bottom Breakdown that forms as a consolidation after a decline would be viewed as a continuation pattern. All the aspects covered under the Triple Bottom Line approach are not.

The Triple Bottom Stock Pattern is a chart pattern used in technical analysis thats identified by three equal lows followed by a breakout above the resistance level. There are three equal lows followed by a break above resistance.

How You Can Implement The Triple Bottom Line

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

Triple Bottom Reversal Chartschool

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

Spotting Triple Bottoms Early Might Help You Get That Dip Buy Entry You Ve Been Looking For Stocks Tr Swing Trading Learn Stock Market Stock Market Training

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

Triple Bottom Pattern And Triple Top The Ultimate Guide

Triple Bottom Pattern And Triple Top The Ultimate Guide

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

Triple Bottom Reversal Chartschool

The Triple Bottom Candlestick Pattern Thinkmarkets En

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-02-8412f60315fe4e75801c37d04bebd526.jpg)

Technical Analysis Triple Tops And Bottoms

Triple Top And Triple Bottom Chart Patterns Trading Charts Stock Market Forex Trading

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

Triple Bottom Pattern And Triple Top The Ultimate Guide

Double Bottom Chart Pattern Strategy