maryland ev tax credit 2021 update

Tax credits depend on the size of the vehicle and the capacity of its battery. On May 28 2021 Governor Hogan announced that he would allow a number of bills to become law without his signature.

Federal Solar Tax Credit What It Is How To Claim It For 2022

Under the proposed Clean Cars Act of 2021.

. One of the bills on. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. EV Tax Credits By Barry Boggs Jr.

Would apply to new vehicles purchased on or after July 1 2017 but before July 1. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the. Up to 26 million allocated for each fiscal year 2021 2022.

Currently looks like the incentives will both be refundable. Will Fund Backlog of EV Tax Credit Applications. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the.

The Maryland legislature also has a bill to. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive. Applications totaling approximately 85 of the funds budgeted for the FY23 EVSE program period have been received with approximately 266582.

The tax credit is available for all electric vehicles. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid.

Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain. Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles. Effective July 1 2023 through June.

Electric car buyers can receive a federal tax credit worth 2500 to 7500. Funding Status Update as of 1122022. 6601 Ritchie Highway NE Glen Burnie Maryland 21062 410-768-7000 1-800-950-1MVA Maryland Relay TTY 1-800-492-4575 Web Site.

Fiscal and Policy Note Revised Synopsis. When you buy an 80000 ev and the federal government uses taxpayers money to reduce your tax bill by ten grand you have been. Maryland HB44 2021 Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles.

Maryland HB44 2021 Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles.

Harris Unveils Plan For Electric Vehicle Charging Network

Arcimoto Vehicles Reclassified As Autocycles In The State Of Maryland Ultra Efficient Electric Vehicles

Electric Vehicle Solar Incentives Tesla Support

Ev Tax Credits And Rebates List 2022 Guide

Heads Up For The Maryland Ev Excise Tax Credit Tesla Motors Club

Montgomery County S Electric Vehicle Purchasing Co Op A Maryland First In The Fight To Stem Climate Change Maryland Planning Blog

Ev State Incentive Programs Rexel Energy Solutions

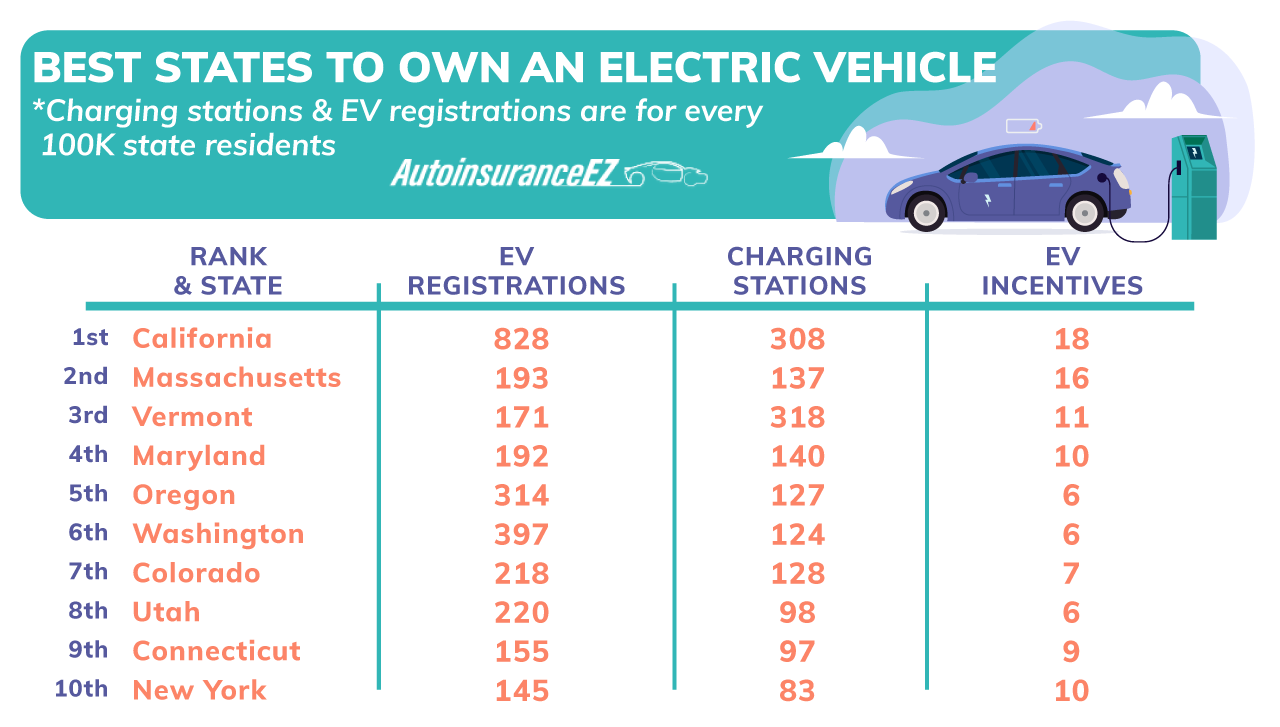

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Maryland And Tax Credit Ev Driven

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Democrats Push Forward With Ev Tax Credits Roll Call

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

4 Benefits Of Getting An Electric Vehicle If You Live In Maryland Darcars Volkswagen Blog

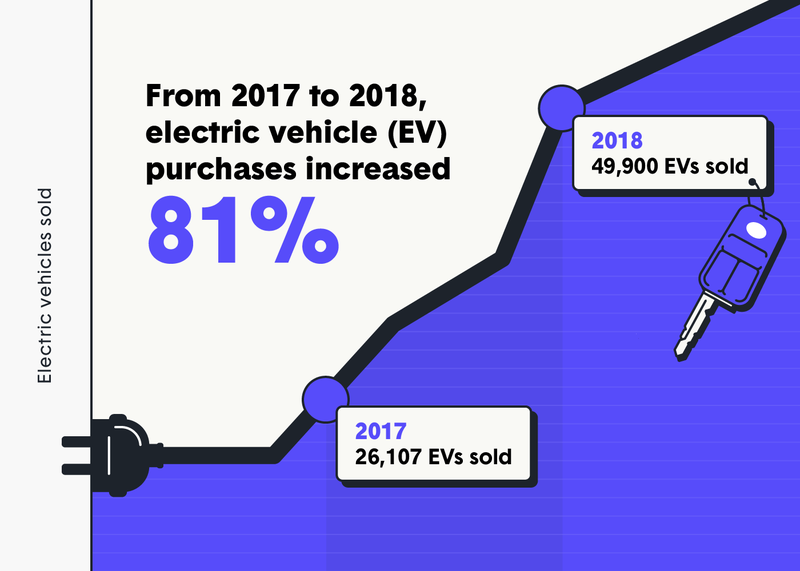

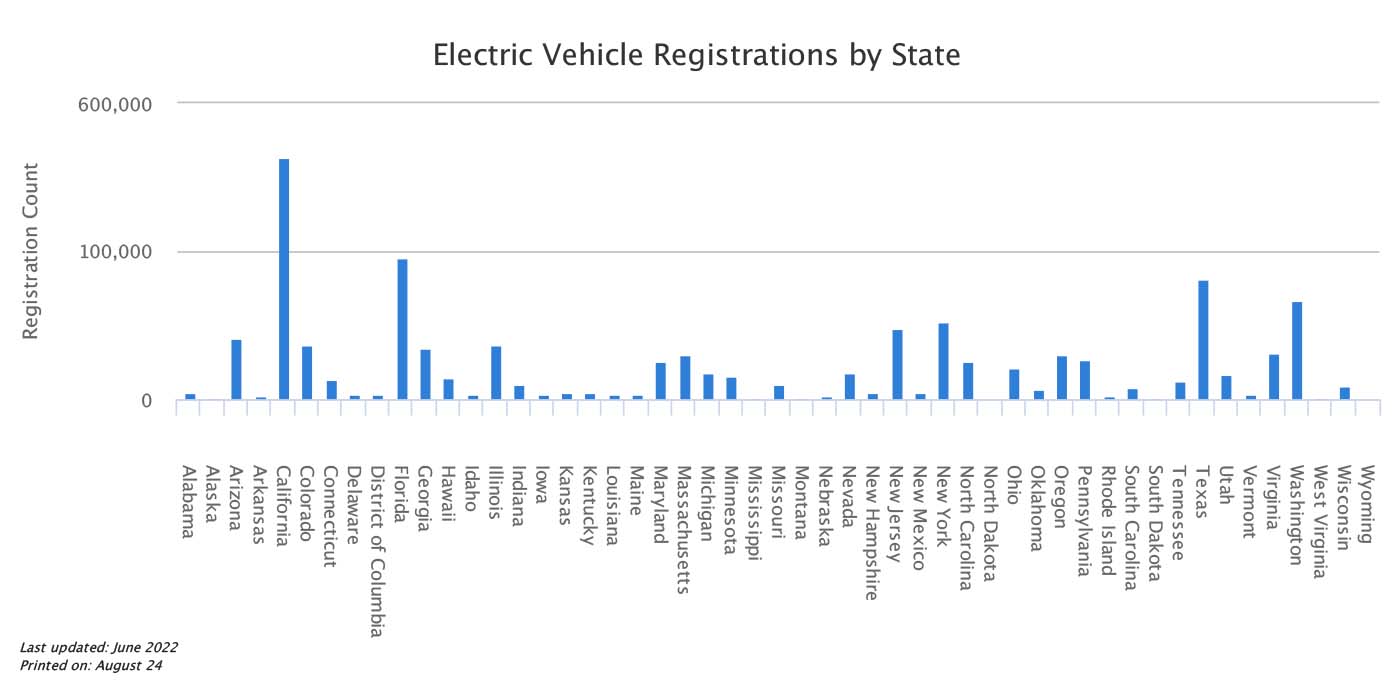

Current Ev Registrations In The Us How Does Your State Stack Up And Who Grew The Most Yoy Electrek

What You Should Know About The Electric Vehicle Tax Credit Updates 2022 Mycpe

The High Cost Of Electric Vehicle Subsidies Zero Emissions Vehicles

.jpg)